unemployment insurance tax refund

If this results in an overpayment the employer account will be credited or a refund may be requested. Tax Refund or Lottery Winnings.

What Is Irs Treas 310 And How Is It Related To 2020 Tax Returns As Usa

Register and Create an Account.

. Department of Labors Contacts for State UI Tax Information and Assistance. Apply for a tax refund. ADWS administers Arkansas Unemployment Insurance UI program and facilitates employer compliance with the Arkansas Employment Security Law collects unemployment insurance contributions from employers provides unemployment insurance benefits to those eligible and maintains management information systems for filing.

The amount that one pays in payroll taxes throughout ones working career is associated indirectly. The purpose of unemployment insurance benefits is to provide short term replacement of lost wages to individuals who lose their jobs through no fault of their own. As our office continues to work closely with the Commonwealth Office of Technology to protect the UI system against fraudulent claims we are asking employers and individuals to take precautions and assist our efforts to ensure you are.

Apply for refund of Value-Added Tax VAT on sea fishing vessels and equipment. And if the worst happens youre covered by a 1 million ID theft insurance policy for eligible losses due to identity theft. The Benefit Payment Control Unit BPCU governed by Section 31-273 of the Connecticut General Statutes and Sections 31-273-1 to 31-273-9 of the Regulations of Connecticut State Agencies is responsible for the prevention detection and recovery of.

Any unauthorized use of this system or schemes to establish fictitious employer accounts file fictitious employer reports or fraudulently claim unemployment benefits will be referred to local state and federal authorities and may result in prosecution by the Office of Inspector General. Officers of for-profit corporations who provide services in Washington are automatically exempt from Unemployment Insurance unless the employer specifically requests coverage. You dont need to include a copy of the form with your income tax return.

Please see below for a detailed listing of inquiry andor request types and associated ATTNs for submissions to the email protected mailbox. Only the employer pays FUTA tax. This includes past-due federal income tax other federal debts such as student loans state income tax child and spousal support payments and state unemployment compensation debt.

It is to your advantage to repay overpayments as soon as possible. If you have questions about potential rates for a new employer please call the Unemployment Tax Helpline at 307-235-3217. The Federal Insurance Contributions Act is a tax mechanism codified in Title 26 Subtitle C Chapter 21 of the United States Code.

For a list of state unemployment tax agencies visit the US. In addition any state tax refund you may be due will be applied to the overpayment in each year an overpayment remains. STATUS UNIT The Status Units primary function is to determine employer liability for UI Tax purposes ensure that.

Under Iowa law Iowa Workforce Development establishes a table each year to determine the unemployment tax rates that will impact eligible employersFactors involved in a formula that determines the rates includes the balance in Iowas unemployment insurance trust fund unemployment benefit history and covered wage growth the release said. Some of the common causes of overpayments include. For more information refer to the Instructions for Form 940.

A general rule of thumb. Unemployment Insurance Agency UIA - For DelinquentUnpaid unemployment debts contact Benefit Payment Control. Unemployment Insurance has been in existence since 1939.

0295 of the taxable wages. The money for unemployment benefits is solely funded by employers by paying taxes into the unemployment insurance trust. We provide the IRS with a copy of this information.

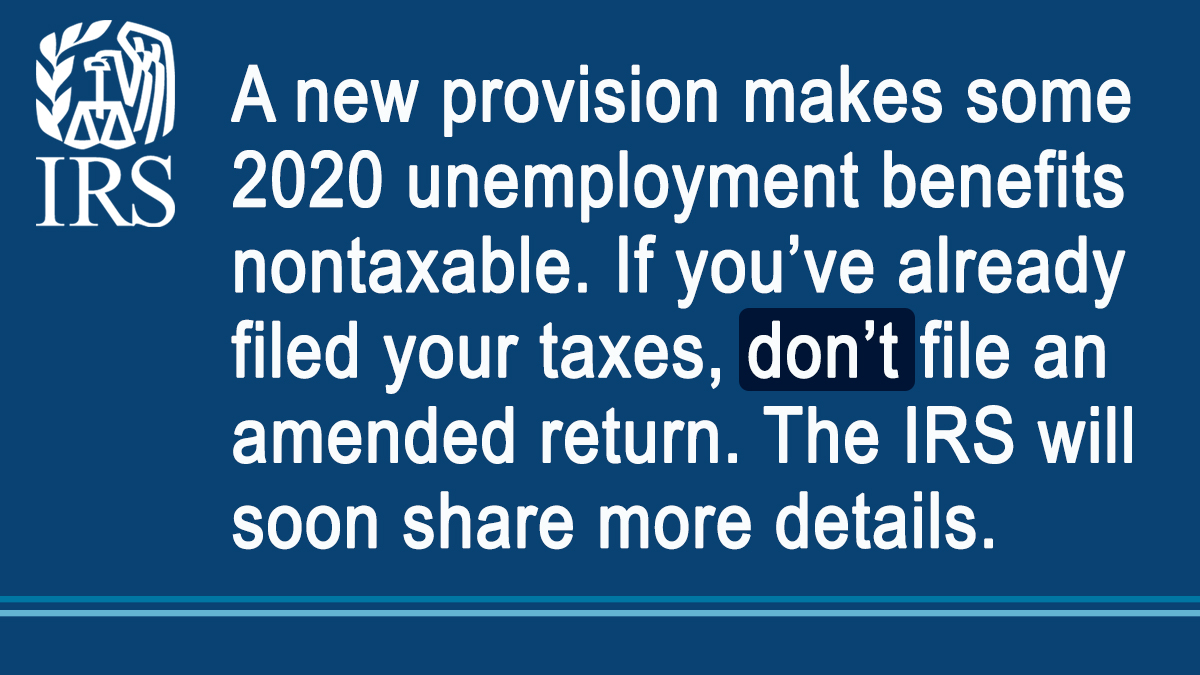

Submit a Voluntary Election Form to the Employment Security Department for optional corporate officer coverage. The Office of Unemployment Insurance has discovered an increase in the number of imposter UI claim attempts. If you have already filed your 2020 Form 1040 or 1040-SR you should not file an amended return.

Apply for refund of Value-Added Tax VAT on marine diesel. If you didnt deduct state and local income taxes last year you dont need to pay taxes on your state and local tax refund this year. Medicare provides hospital insurance benefits for the elderly.

Most employers pay both a Federal and a state unemployment tax. Get Tax Form 1099G for Your Federal Tax Return. What can cause an overpayment of Unemployment Insurance Benefits.

How Do Employers. Claim tax relief on adapted vehicles for qualifying organisations. A claimant andor an employer fail to disclose that the claimant received vacation or severance pay or other similar pay after a job separation.

Unemployment and stimulus frauds. File a Mineral Oil Tax MOT e-repayment claim. For your unemployment insurance account call the UI Employer Hotline at 1-888-899-8810.

Your bank blocks your tax refund check. Apply for refund of Value-Added Tax VAT on aids and appliances for persons with disabilities. Chapters 42-62-71 and.

The IRS will automatically refund money to people who already filed their tax return reporting unemployment compensation or in some circumstances the IRS will apply the refund money to tax debts or other debts owed by the person entitled to the. Calls from tax agencies other than the IRS. Refund of Unemployment Credit.

Social security benefits include old-age survivors and disability insurance OASDI. You cannot collect both programs at the same time. Creating an account is an important step as soon as you qualify for unemployment benefits.

Once an employer becomes eligible for experience rating they will receive one of 18 unemployment insurance UI tax rates ranging from 25 percent to 540 percent of taxable wages. Email protected ATTN. A DWD decision reverses a previous award of UI benefits to a claimant.

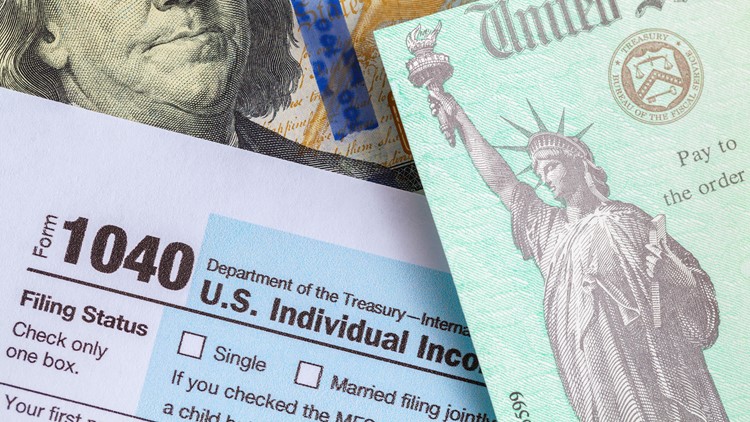

Form 1099-G Income Tax Statement showing the amount of Unemployment Insurance benefits paid and amount of federal income tax withheld will be in January following the calendar year in which you received benefits. To collect Unemployment Insurance Benefits you must be able available and actively seeking full-time work. The Kentucky Unemployment Insurance Commission is taking the appropriate steps to seek the Kentucky Supreme.

Unemployment insurance is taxable income and must be reported on your federal and state income tax returns. If you do not repay your overpayment it will be recovered by future benefits your tax refunds lottery winnings or a referral to a collection agency. You will be notified if the refund you claimed has been offset against your debts.

For instance if you didnt itemize your deductions last year and instead you took the standard deduction then your state tax refund from the previous year is tax-free this year. In some instances employers may overpay. For questions about other changes to your withholding tax account call the Tax Department at 518-485-6654.

If you are using a paid preparer or a payroll service the section below must be completed. The Courts decision if it becomes final will affect employers as it invalidates the states current statute allowing non-attorneys to represent an employer in administrative proceedings related to unemployment insurance claims. Assists employers with all unemployment insurance and tax concerns and serves those who need and are eligible for unemployment insurance benefits.

All inquiries and requests for the DOES UI Tax Division should be emailed to email protected. Click here for Fraud Prosecution Program details and how to report suspected fraud. The EDD manages the Unemployment Insurance UI program for the State of California.

It is not deducted from the employees wages. If all or part of your income tax refund was taken to pay a debt that you owe the State of Michigan you will receive a Notice of Adjustment to Income Tax Refund letter that provides you with detailed information about your refund. Report School or Training.

Unemployment Benefits Another Batch Of Corrections This Year Marca

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

1 816 Unemployment Benefits Stock Photos Pictures Royalty Free Images Istock

2020 Tax Tips Unemployment Furloughs Stimulus Payments How They Impact Your Tax Filings Atlantic Financial Fcu Baltimore Md Hunt Valley Md

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

When Will Irs Send Unemployment Tax Refunds 11alive Com

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Interesting Update On The Unemployment Refund R Irs

Irs Sending You More Money Unemployment Refunds Coming King5 Com

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

When Will Irs Send Unemployment Tax Refunds 11alive Com

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Is Unemployment Compensation Going To Be Tax Free For 2021

Report Unemployment Benefits Income On Your Tax Return

Irs Continues Unemployment Compensation Adjustments Prepares Another 1 5 Million Refunds The Southern Maryland Chronicle

The Irs Will Refund Those Who Overpaid Taxes On Unemployment Benefits

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com