how to calculate nh property tax

Search Any Address 2. The RETT is a tax on the sale granting and transfer of real property or an interest in real property.

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

2022 Town Meeting Minutes.

. Find All The Record Information You Need Here. Exemptions New Hampshire state law provides. To calculate the annual tax bill on real estate when the property owner isnt eligible for any.

The result is the tax bill for the year. See Property Records Tax Titles Owner Info More. Search Any Address 2.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Jackson determines tax rates all within New Hampshire constitutional rules. Property Tax Relief Program.

For a house assessed at 250000 multiply the value by 2316 and divide by 1000 to get the annual tax bill 5790. How to Appeal PropertyTaxes in New Hampshire. Get In-Depth Property Tax Data In Minutes.

RSA 7616 contains the deadline for filing property tax. Taxpayers must also be given a reasonable notice of rate rises. 2022 Town Election Results.

Voted Appropriations minus All Other Revenue divided by Local Assessed Property Value Rate. See Results in Minutes. That information is then used in the formula below to calculate the local property tax rate.

Lookup An Address 2. New Hampshire Real Estate Transfer Tax Calculator The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. The New Hampshire Department of Revenue Administration NHDRA is responsible for fairly and efficiently administering the tax laws of the State of New Hampshire.

Stark establishes tax rates all within New Hampshire constitutional rules. 300000 1000 300 x. However reserved for the county are appraising.

Property tax filing deadlines are generally uniform throughout the state. Ad Enter Any Address Receive a Comprehensive Property Report. How to Calculate Your NH Property Tax Bill 1.

New Hampshires tax year runs from April 1 through March 31. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev. See Property Records Deeds Owner Info Much More.

Reserved for the county however are appraising property mailing bills making collections carrying out compliance. The assessed value of the property 2. For comparison the median home value in New.

Hebron has the lowest property tax rate in New Hampshire with a tax rate of 652 while Claremont has the highest property tax rate in New Hampshire with a tax rate of 4098. Start Your Homeowner Search Today. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax.

Unsure Of The Value Of Your Property. View. The local tax rate where the property is situated 300000 1000 300 x 2306 6910 tax bill 1.

See Property Records Deeds Liens Mortgage Much More.

45 Walker Hill Road Ossipee Nh Real Estate Mls 4898019 Adam Dow In 2022 Ossipee Road Country Roads

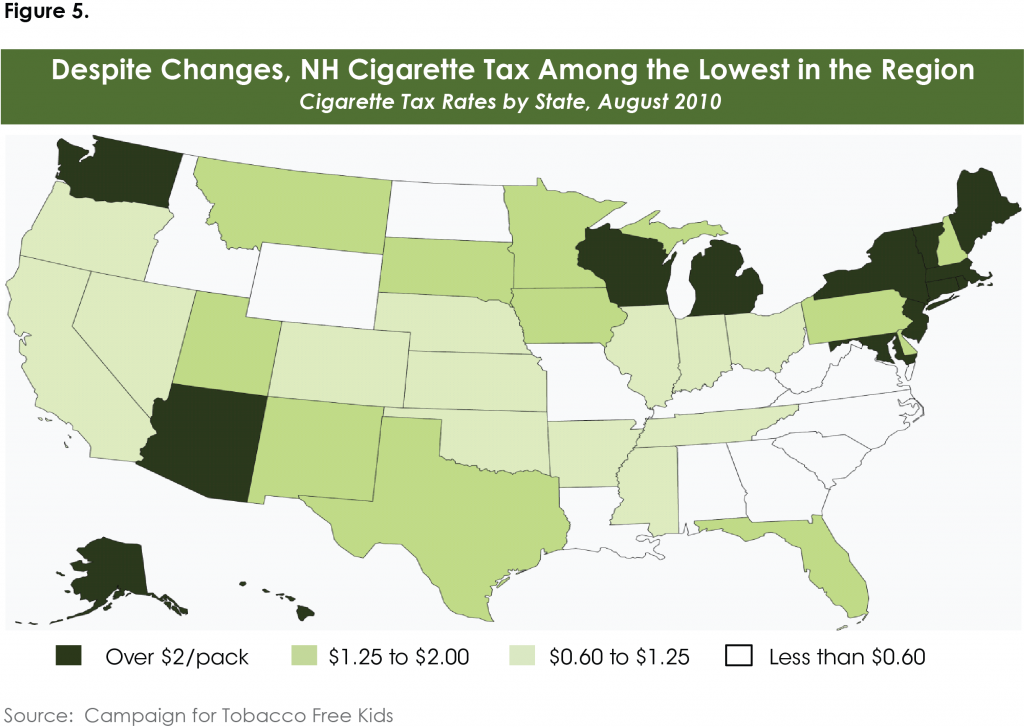

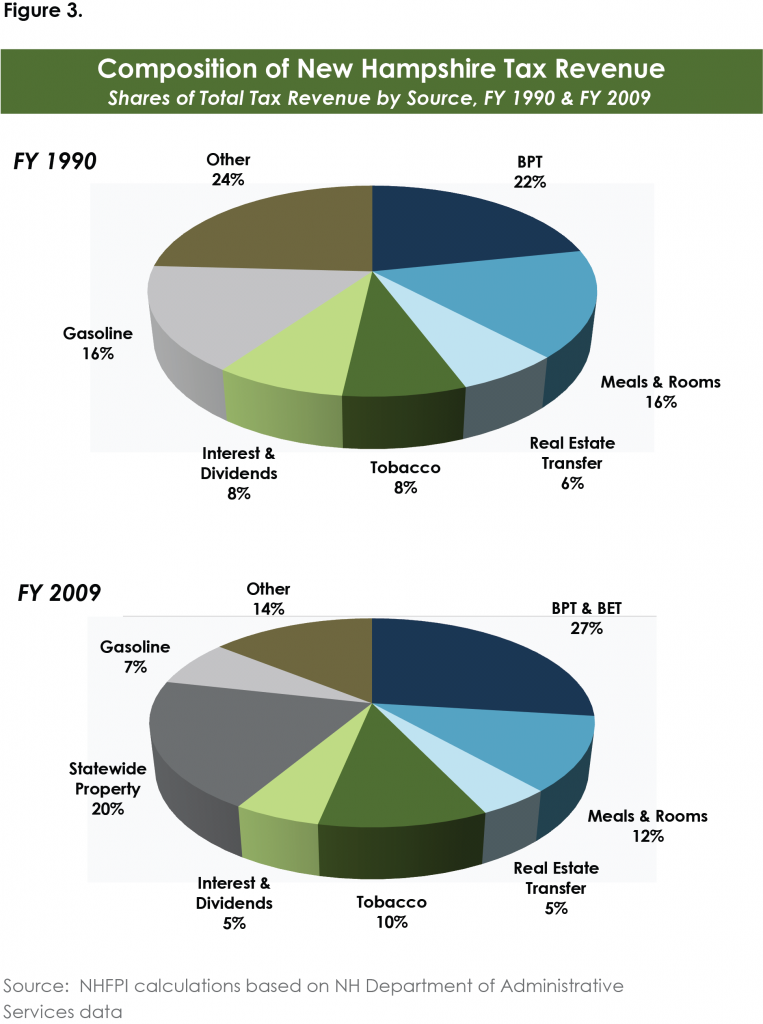

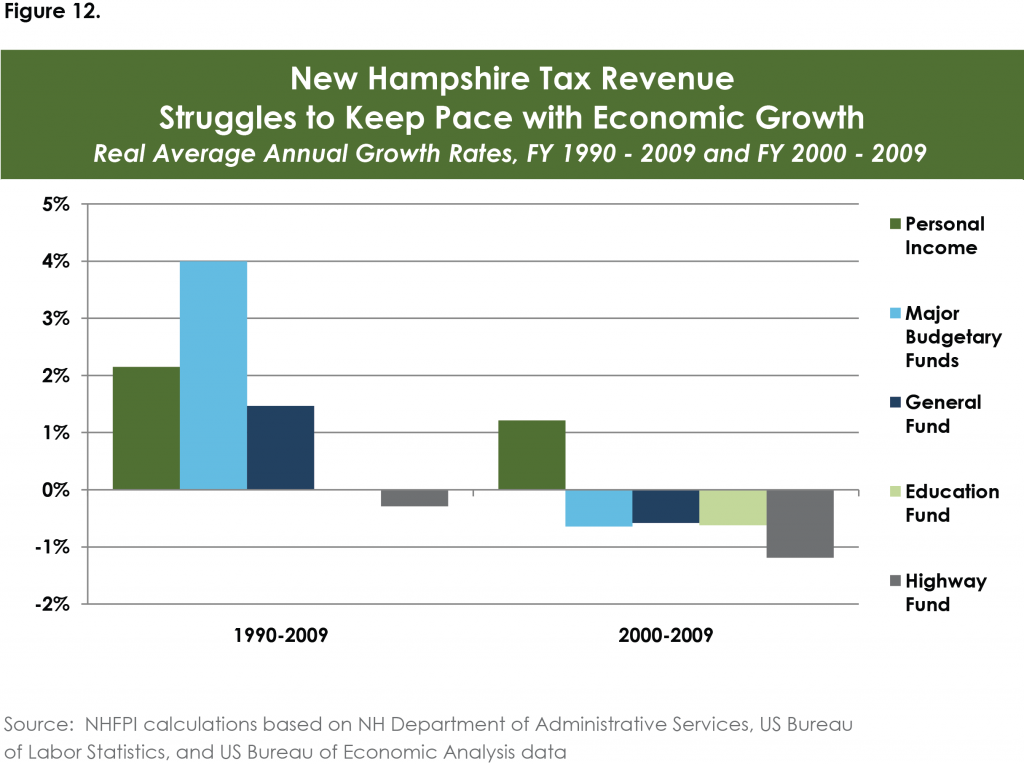

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Nh Had Seventh Highest Effective Property Tax Rate In 2021 Report Says Nh Business Review

New Hampshire Property Tax Calculator Smartasset

How To Calculate Transfer Tax In Nh

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Understanding New Hampshire Taxes Free State Project

New Hampshire Income Tax Calculator Smartasset

2021 Tax Rate Set Hopkinton Nh

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Town Manager Announces Tax Rate Set At 26 36 Newmarket Nh

The Ultimate Guide To New Hampshire Real Estate Taxes

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning